Why Steel Rolling Mills is a case both for and against a government bailout for distressed Ugandan businesses

KAMPALA, JULY 12 – Since the presentation of Uganda’s budget for fiscal 2016/17, the dire straits of Ugandan businesses and their proposed bailout has been a constant theme. It was reported at some point that the government planned to borrow UGX 2 trillion from the NSSF for this purpose while other reports suggested that the government had opted to expedite the clearance of domestic arrears instead.

As the markets were waiting for clarity, news came that Uganda’s largest steel miller, Steel Rolling Mills – the only A to Z producer of high tensile steel- a member of the Alam Group, had succumbed to the burden of un-serviced loans and a huge tax liability, to be placed under receivership.

SRM owed Standard Chartered’s Ugandan unit more than UGX 50 billion and combined with the tax liabilities from other Alam Group subsidiaries, a combined bill in excess of UGX13 billion in tax arrears.

Given the position it occupies in the industry and its true Ugandan heritage – Alam has stayed the course of Uganda’s turbulent history never once turning its back on the country- the company should be a good candidate for a government bailout. Indeed, 256BN has learned that the Managing Director, Abid Alam, has been to see President Museveni, specifically to negotiate tax relief.

In principle, there should be nothing wrong with helping a strategic enterprise such as Alam out of trouble but this has to be approached carefully. Before any bailout, it will be important to understand how Alam got here.

Available information so far suggests that the company’s problems are not far from a disease common to Ugandan family owned enterprises. Alam lacked a coherent management structure as the MD usurped all power. Attempts at meetings by the family members who constitute the board often ended in chaotic scenes where the coffee cups were turned in to missiles.

Without the oversight of a management board, Abid Alam blundered into traps such as the decision to take multiple loans locally from different financial institutions and then diverting the proceeds to other projects.

The failure to pay the StanChart loan is not entirely unconnected with the decision to set up a sugar factory that opened in Kaliro district in November 2013. Abid gambled on the promising strategy of co-generating power and selling it to the national grid but was let down by a bureaucracy that has to date neither concluded a power purchase agreement nor built a transmission line to inject the power into the national grid. As a result, the Alam group remains with about 9Mw of power and by extension revenue, stranded some 34 kilometres from the nearest interconnection point.

Yet it was not always gloom for the steel miller. With the only sponge iron plant in the region, SRM was the only supplier that could meet the needs of international civil contractors and had won a contract to supply steel for the 600Mw Karuma Hydropower Project. That contract was to be terminated later amidst quality lapses detected by the Chinese civil contractor. In one year, SRM has employed three different Chief Accountants.

Saving SRM through a government bailout therefore raises some basic but important questions. How would you deal with the management excesses that have brought the once vibrant firm to its knees and how do you ensure the bailout does not become a case of throwing good money after bad money?

In the final analysis, SRM’s troubles and strategic position support the case for a bailout but the form matters. On the other hand, SRM’s management lapses clearly show that the firm’s trials are not the result of tight economic conditions and militate against a rushed bailout.

In the circumstances appointing a receiver manager to run the affairs of the company might have been a good middle of the road approach. It gives everybody to test the soundness of the business and establish if it can recover from its unusual attitude. Indeed reports from inside the company report a promising picture ever since the receivers moved in. Production is up and the orders are coming in. It now remains to be seen what course Karamagi Kabiito chooses but President Museveni may do well to stand aside for a while.

Shell Club rewards first winners with brand new motorbikes in Mbale

Shell Club rewards first winners with brand new motorbikes in Mbale

CSBAG roots for increased funding for renewable energy

CSBAG roots for increased funding for renewable energy

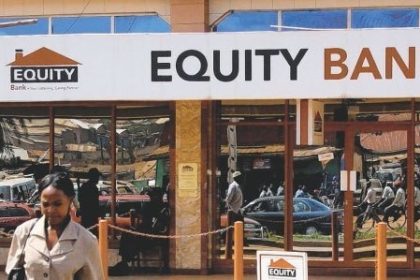

Equity walks tried and tested path to deliver solid half-year

Equity walks tried and tested path to deliver solid half-year

Nile Breweries primes retailers for brave new world

Nile Breweries primes retailers for brave new world

Uganda calls for collaboration with airlines in fight against illicit trade in wildlife

Uganda calls for collaboration with airlines in fight against illicit trade in wildlife

Airline industry top guns dust-off passports for Uganda hosted 55th AFRAA annual meet

Airline industry top guns dust-off passports for Uganda hosted 55th AFRAA annual meet