Small scale farmers given credit lifeline to ease collateral worries

By September 2020, the ACF had advanced UGX 2.8 billion (nearly $760,000) to 187 small and micro borrowers.

By September 2020, the ACF had advanced UGX 2.8 billion (nearly $760,000) to 187 small and micro borrowers.

Small scale farmers who usually miss out on commercial loans due to lack of adequate collateral are benefiting from an alternative scheme being touted by the Agricultural Credit Facility (ACF) administered by Bank of Uganda (BoU). Actual lending is done by participating financial institutions.

Termed as ‘block allocation’, loans of up to UGX 20 million (just short of $5500) are being extended to farmers based on alternative collateral such as chattel mortgages, cash flow based financing, and character-based loans, among others.

Dr. Michael Atingi-Ego, the Deputy Governor, said in mid-week, “This innovation is unlocking access to credit in areas with communal land tenure; and most especially, for micro and smallholder farmers who are otherwise excluded for lack of collateral to secure credit. By September 2020, the ACF had advanced UGX 2.8 billion (nearly $760,000) to 187 small and micro borrowers with non-traditional collateral under block allocation.”

In his remarks to launch the 2020 Agricultural Finance Yearbook, Dr. Atingi-Ego said block allocations support financial inclusion and advance equity in economic activity by serving women and youths with limited property rights. The yearbook presents interventions to improve value-chain development and the investment climate within select areas of the agricultural sector.

The Deputy Governor said extending the value-chains beyond internal markets, and linking them to regional and global value chains, will require a supportive legal framework that can attract intra-African investments. It is also necessary to ease trade (particularly for fertiliser and agro-machinery), develop relevant agro-industrialisation policies that ensure enforcement mechanisms for commodity auctions, warehousing, and central trading platforms.

Dr. Atingi-Ego said BoU administers the ACF on behalf of the government and supports medium and long-term financing to agricultural projects, agro-processing, and grain trade, among others, at lower than market interest rates.

The ACF was set up by the government in partnership with licensed commercial banks, the Uganda Development Bank Limited (UDBL), Micro Deposit Taking Institutions (MDIs) and Credit Institutions all referred to as Participating Financial Institutions (PFIs).

The scheme’s operations started in October 2009, with the aim of facilitating the provision of medium and long term financing to projects engaged in agriculture and agro processing, focusing mainly on commercialization and value-addition.

Loans under the ACF are disbursed to farmers and agro-processors through the PFIs at more favourable terms than are usually available under conventional loans.

He said, “The ACF is catalyzing agricultural commercialization, modernization, and value addition. And the facility has great potential to extend financial inclusion and economic equity. We call upon the government to continue to support the facility by boosting the capital available to on-lend to the agricultural sector.”

“I am happy to report that since inception in 2009 up to September 2020, Government contributed UGX 153.56 billion (just over $41 million), which together with reflows (repayments from PFIs) of UGX 141.98 billion, supported cumulative lending of UGX 267.19 billion out of the ACF. The majority of the loans have performed satisfactorily, funding a broad range of projects including on-farm activities, grain trade, post-harvest management, and agro-processing,” Dr. Atingi-Ego said.

He said about 56 pc of the funded projects belonged to micro, small and medium-sized enterprises, considered the engine of job creation. “And with a notable repayment rate, as seen through a non-performing loan ratio of 2.2 percent compared to 5.1 percent for banks in September 2020, the high reflows imply that for every shilling of Government capitalization, the ACF operations generate approximately an extra shilling for additional onward lending to viable projects. There is a strong multiplier impact of the Government’s contribution to agricultural development through the facility,” he said.

100+ Accelerator selects Ugandan startup Yo-Waste to pilot glass recycling at Nile Breweries

100+ Accelerator selects Ugandan startup Yo-Waste to pilot glass recycling at Nile Breweries

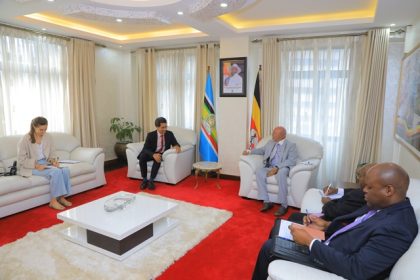

With eyes on oil and gas, France pledges USD 3 billion investment in Uganda

With eyes on oil and gas, France pledges USD 3 billion investment in Uganda

Uganda urged to pitch for organic produce during NAM Summit

Uganda urged to pitch for organic produce during NAM Summit

NOGAMU’s Namuwoza tapped to lead bid for increased intra-African trade in organics

NOGAMU’s Namuwoza tapped to lead bid for increased intra-African trade in organics

From 3 padlocks to a click: Sipi Organic’s long walk to digital banking

From 3 padlocks to a click: Sipi Organic’s long walk to digital banking

Nile Breweries launches UGX 4Bn barley processing facility in Kween district

Nile Breweries launches UGX 4Bn barley processing facility in Kween district