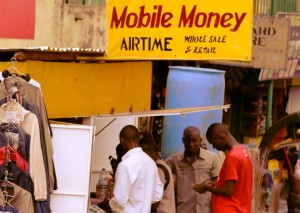

Proposed 1% tax on mobile money may hurt SMEs

May 7, 2018—Owners of small and medium enterprises (SMEs) will face the worse of the effects from a proposed 1% tax on all mobile money transactions according to the Civil Society Advocacy Group (CSBAG). Latest Bank of Uganda figures show that during 2017 these transactions totaled UGX54 trillion ($14.5 billion).

The government plans to make it official in the forthcoming national budget for 2017/18 next month in a bid to increase annual tax revenues. CSBAG says the tax will hurt SMEs, because they use mobile money services substantially more than bigger companies in the course of their day-to-day business operations.

However, Julius Mukunda, the CSBAG executive director told legislators last week as part of a campaign to force the government into making an about-turn, 61 % of the MTN mobile money clients transfer less than UGX45,000 ($12). He said imposing the 1% transaction value tax will negatively impact this segment of customers who mostly live in rural areas and rely on the service.

According to CSBAG the government should instead increase the excise duty from 10% to 17% on mobile money withdrawal fees. CSBAG believes this could generate about UGX122 billion (nearly $33 million).

African Heads of state head to South Korea next week for Summit talks

African Heads of state head to South Korea next week for Summit talks

Trading leads as main source of income for Ugandans

Trading leads as main source of income for Ugandans

New leadership for bankers’ umbrella as total assets top $12 billion

New leadership for bankers’ umbrella as total assets top $12 billion

Brussels Airlines to announce Nairobi service

Brussels Airlines to announce Nairobi service

SITA promises enhanced travel experience after Materna acquisition

SITA promises enhanced travel experience after Materna acquisition

Saudia’s 105 aircraft order stretches A320neo lead over rival Max

Saudia’s 105 aircraft order stretches A320neo lead over rival Max