FITSPA routes for proactive regulation

July 25, 2018 – The Bank of Uganda BoU, will adopt proactive regulation as part of efforts to support the development of Uganda fledgling Financial Technology industry.

July 25, 2018 – The Bank of Uganda BoU, will adopt proactive regulation as part of efforts to support the development of Uganda fledgling Financial Technology industry.

The pledge was made July 12 by the BoU’s Director for Bank Supervision Dr Tumubweine Twinemanzi, during the annual general meeting of the Financial Technology Service Providers Association FITSPA, where he was chief guest.

Twinemanzi said the regulator would before year end introduce regulatory sandboxes to support innovation by FinTech firms.

Responding to appeals by FinTech firmsd for regulation that fosters rather than smother innovation, Twinemanzi observed that the current capital structure within Uganda’s banking industry constrains the ability of commercial banks to spearhead innovation.

“The fragile capital structure among commercial banks means that on their own, they find it prohibitive to invest in innovation. FinTech firms are therefore playing a critical role in fast tracking technologies that bring services and convenience to consumers,” he said.

To support FITSPA bridge the innovation gap, Twinemanzi said the regulator would soon introduce regulatory sandboxes – an approach to regulation where certain regulations are put in abeyance for a period, to allow innovators pilot new technologies products ahead of mass rollout.

Founded last August, the 15 member FITSPA has been driving efforts to bring a cashless economy closer to Ugandan consumers.

Speaking earlier, FITSPA Board Chair Mr. Muyiwa Asagba said the association was looking to stronger bonds and partnerships with other associations such as the Bankers Association, Micro Finance Association and Insurers Association among others to drive the creation of value within the financial services ecosystem.

Shell Club rewards first winners with brand new motorbikes in Mbale

Shell Club rewards first winners with brand new motorbikes in Mbale

CSBAG roots for increased funding for renewable energy

CSBAG roots for increased funding for renewable energy

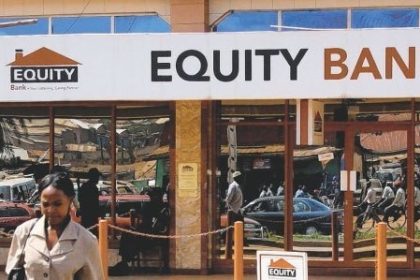

Equity walks tried and tested path to deliver solid half-year

Equity walks tried and tested path to deliver solid half-year

Nile Breweries primes retailers for brave new world

Nile Breweries primes retailers for brave new world

Uganda calls for collaboration with airlines in fight against illicit trade in wildlife

Uganda calls for collaboration with airlines in fight against illicit trade in wildlife

Airline industry top guns dust-off passports for Uganda hosted 55th AFRAA annual meet

Airline industry top guns dust-off passports for Uganda hosted 55th AFRAA annual meet