Dutch bank funds Ugandan mini power projects

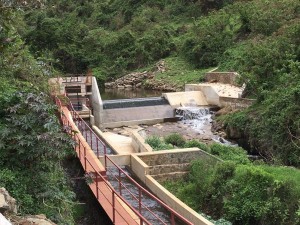

The 5 MW Siti 1run-of-the-river projects is already providing electricity to 60,000 homes, schools and businesses in the Mount Elgon area.

May 25–FMO, the Dutch development bank, is providing a $35 million loan to develop the 5 MW Siti 1 and the 16.5 MW Siti 2 run-of-the-river hydro-power projects in eastern Uganda. Siti 1 started generating electricity early this month for 60,000 homes, schools and business in the Mount Elgon area.

Both projects are developed and owned by Elgon Hydro Siti Limited (Elgon). Elgon is majority owned by DI Frontier Market Energy & Carbon Fund K/S (Frontier Energy), a Danish private equity fund managed by Frontier Investment Management that is developing and implementing a portfolio of renewable energy projects in Eastern Africa.

Besides the Ministry of Energy and Minerals Development, the Electricity Regulatory Authority, Uganda Electricity Transmission Company Limited and the Rural Electricity Agency are all involved in relevant aspects of the project.

This is the first of a larger plan with Frontier Energy to arrange $83 million financing for five more small hydros in Uganda, totaling 47MW.

FMO syndicated 50% of the Siti projects to the Emerging Africa Infrastructure Fund (EAIF). As a leading impact investor, FMO supports sustainable private sector growth in developing countries and emerging markets by investing in ambitious projects and entrepreneurs.

With a committed portfolio of EUR 9.8 billion ($11 billion) spanning over 85 countries, FMO is one of the larger bilateral private sector developments banks globally.

The project is developed under the Global Energy Transfer Feed in Tariff (‘GET FiT’), a dedicated support scheme for renewable energy projects managed by Germany’s KfW Development Bank in partnership with Uganda’s Electricity Regulatory Agency (ERA) and funded by Norway, Germany, the United Kingdom and the European Union.

The GET FiT programme helps renewable energy sources become more affordable and therefore more accessible in Eastern Africa. GET FiT is providing a subsidy of EUR 2.9 million in the form of result based premium payments per kWh of delivered electricity.

African Heads of state head to South Korea next week for Summit talks

African Heads of state head to South Korea next week for Summit talks

Trading leads as main source of income for Ugandans

Trading leads as main source of income for Ugandans

New leadership for bankers’ umbrella as total assets top $12 billion

New leadership for bankers’ umbrella as total assets top $12 billion

Brussels Airlines to announce Nairobi service

Brussels Airlines to announce Nairobi service

SITA promises enhanced travel experience after Materna acquisition

SITA promises enhanced travel experience after Materna acquisition

Saudia’s 105 aircraft order stretches A320neo lead over rival Max

Saudia’s 105 aircraft order stretches A320neo lead over rival Max